Learn how to use this free feature for clients who issue payment slips via PJBank

The Collection Process works as a guide for finance collection, in which each point of contact has a personalized message sent along with the updated payment slip directly from iClips. You can define which will be the dates and messages to send the slip, and, with that, the chance of receiving payment on time by your clients is enhanced.Important: This feature is only available for the issue of slips via PJBank.

How to set up the collection process?

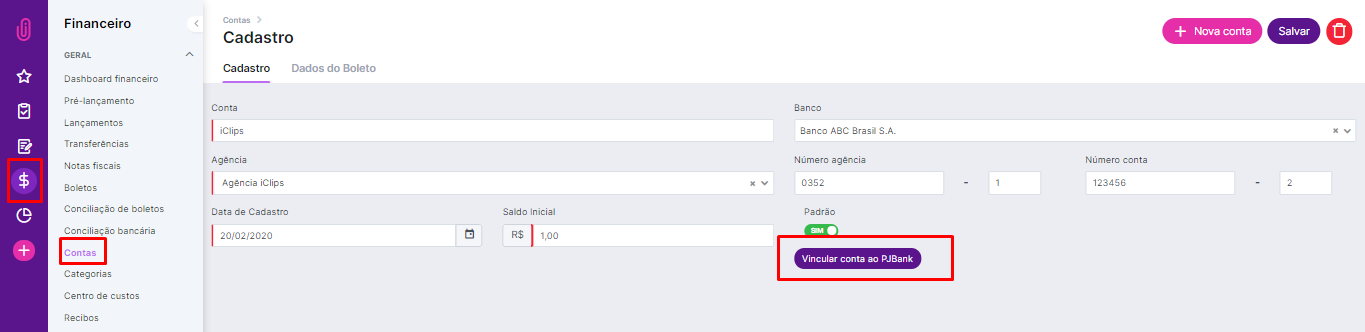

If you don't use PJBank yet to issue your slips, the first step is to link your account to it. Go to the Finance Module > Account, edit the desired account and click on ‘Link account to PJBank’.

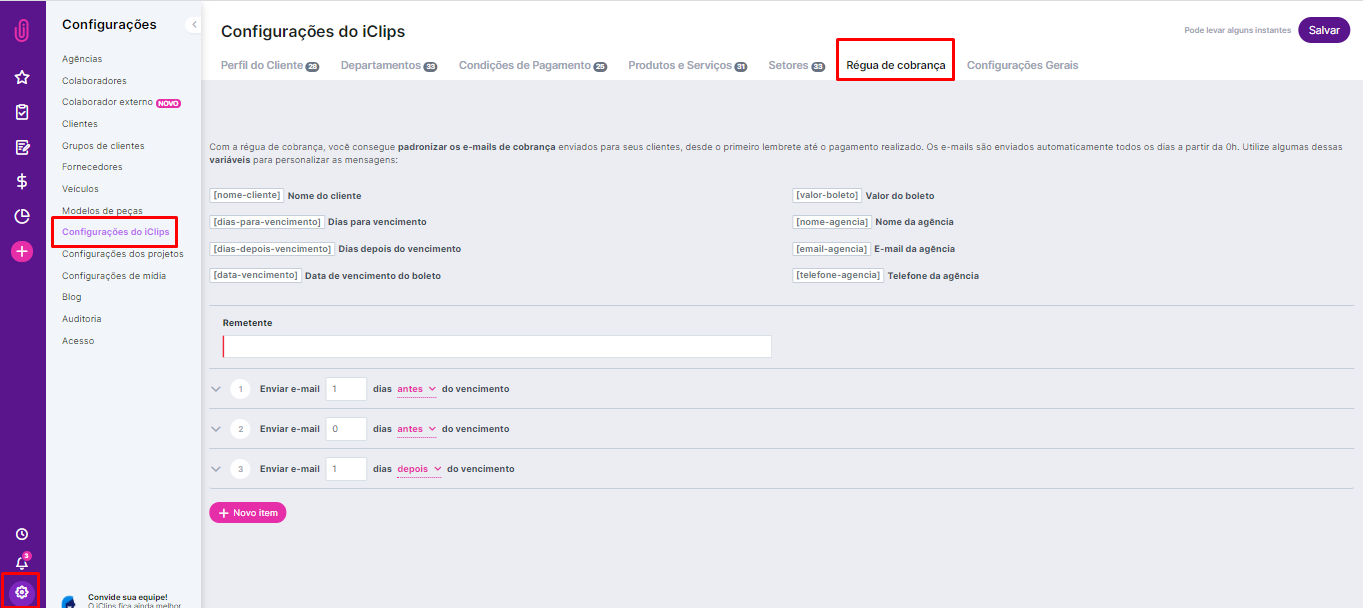

Defining what your collection process will look like: Go to Settings > iClips Settings > Collection Process. This is the home screen:

Some important information:

- You can customize the subject and body of the e-mail.

- To make your life easier, we initially suggest three e-mails for your process: 5 days before the due date, on the day of the due date and 5 days after. But you can change these deadlines and add new messages according to your needs, like 10 or 2 days before the due date. It is also nice to run A / B tests and analyze which strategies will work best for you.

- E-mails are sent automatically every day from 0:00.

- If you want to send a slip on the due date, enter 0 (zero) days before or after the due date.

- When the entry is posted manually, the process will be automatically disabled.

- If you change the way the sending process is done, everything that has already been set up will change to the current configuration.

- Some variables are available so that you can personalize the messages, such as the client's name, slip amount and agency e-mail. That way, you can set up your e-mail according to the desired message, giving enough information for the client to make the payment. The keyword here is ease. When you start typing the name of the variable in the body of the e-mail, iClips suggests the possible alternatives for you to select.

Tips:

Pay attention to the language used: even though the default is harmful to your agency, it is a delicate moment and the way you charge your client makes all the difference. Be clear, inform which products and services generated that charge and how he can pay it off. Also, don't forget to ask the client to disregard the e-mail if they have already paid the slip.- Make it clear on which channels he can reach you. As simple as the process is, at some point the client may have to report a technical problem, ask questions or send a receipt to speed up the delivery of a service. That is why it is important that the e-mail has a phone number or e-mail address of the person that can help clients, whether it is the account service or the agency finance.

How to put the Collection Process to work?

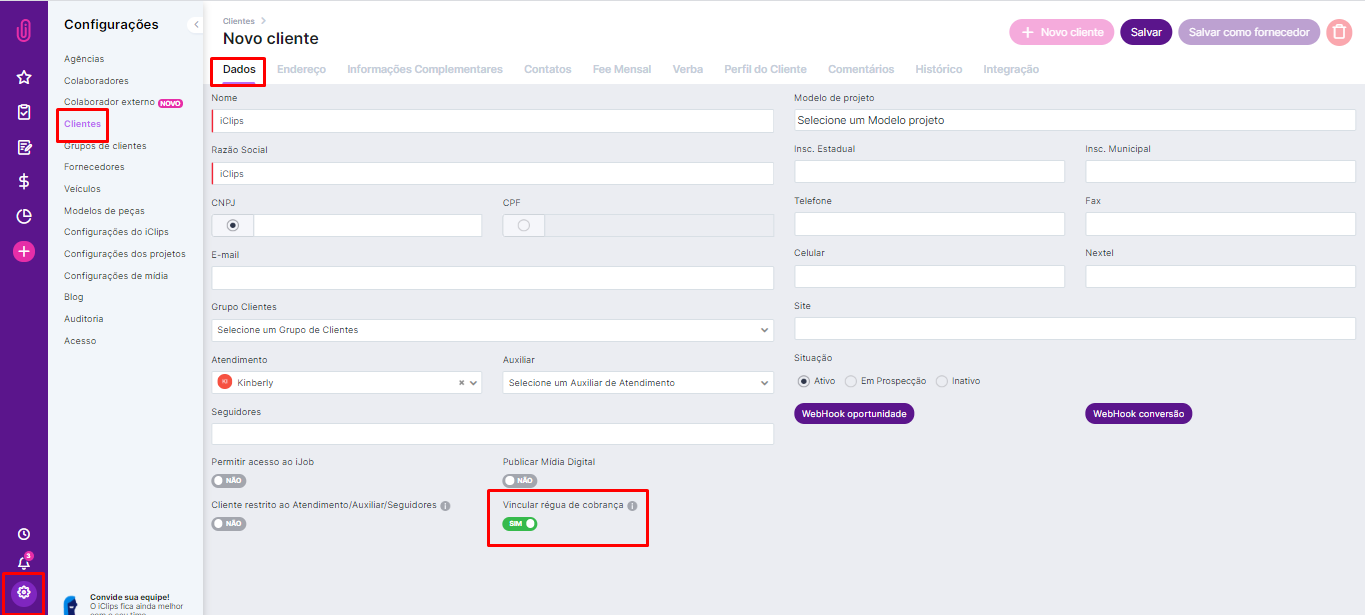

Go to Settings > Clients, edit the client you want and in the tab ‘Data’, check the option ‘Link Collection Process’.

Thereafter, all entries to be received from this client will be affected by the process and the slips will be created automatically!

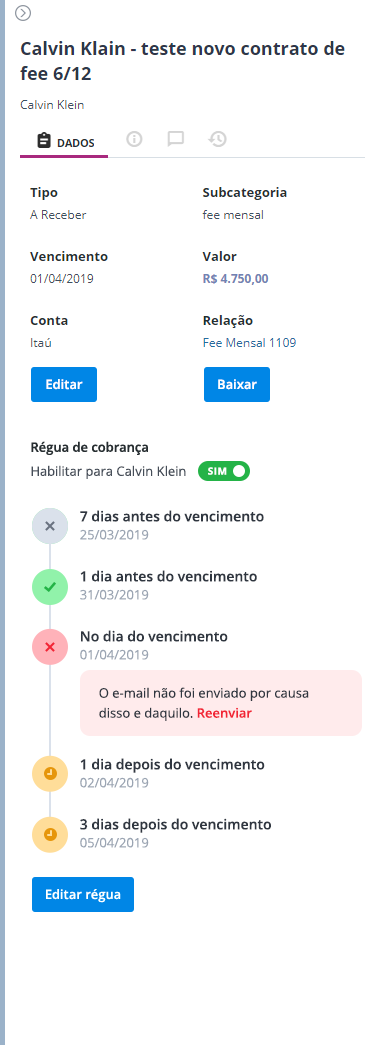

You can monitor the flow of e-mail messages in the menu on the right side of Finance Entries.

Bear in mind that when the slip is paid, that is, when the money is credited into your account, the entry is automatically posted to your iClips.

In addition to making the collection more professional, improving financial receipts and helping to prevent default, the collection process optimizes the agency's processes and keeps the client close by, in a healthy relationship.

In addition to generating a slip with a record, you can also reconcile the slips with your return file, learn more about it here.

.png?height=120&name=rockcontent-branco%20(1).png)