In this article, you will understand what types of billing your agency can work with

What are the billing types?

They are the ways to deal with your finance area within iClips. These billing types determine how the sector will receive the income and expense information through what you have filled out in the ‘Media Map (PI)’ and also in the ‘O.S.’

We can keep the predefined billing types in the client’s record, but this does not prevent them from being changed in the future according to the agency's negotiation with the client or the supplier/vehicle.

We have three types of billing that appear as follows:

Direct to the client

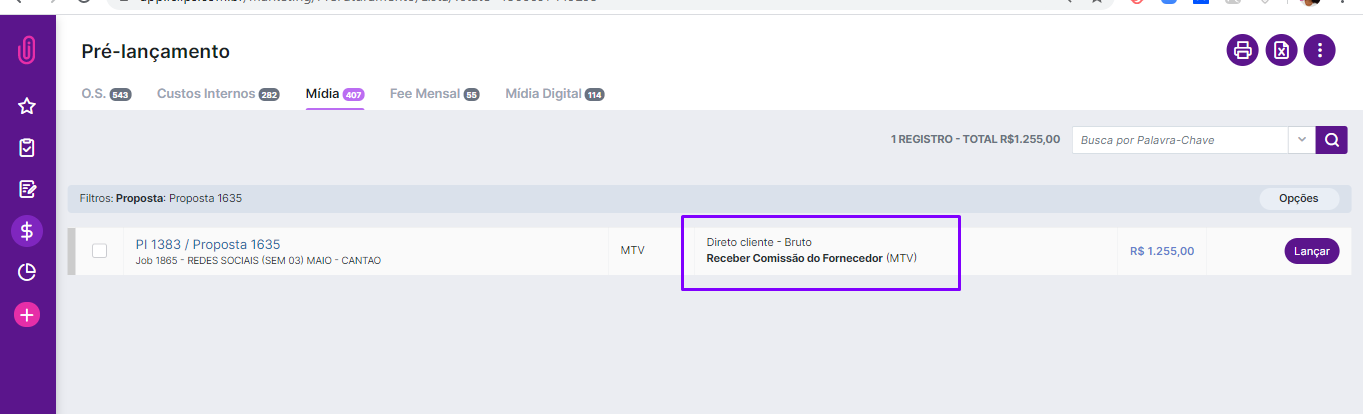

The collection is done directly between the supplier/vehicle and the client in question. It will be up to the agency to bill only the commission (when and if any).

See how this type of billing reaches the finance of the agency:

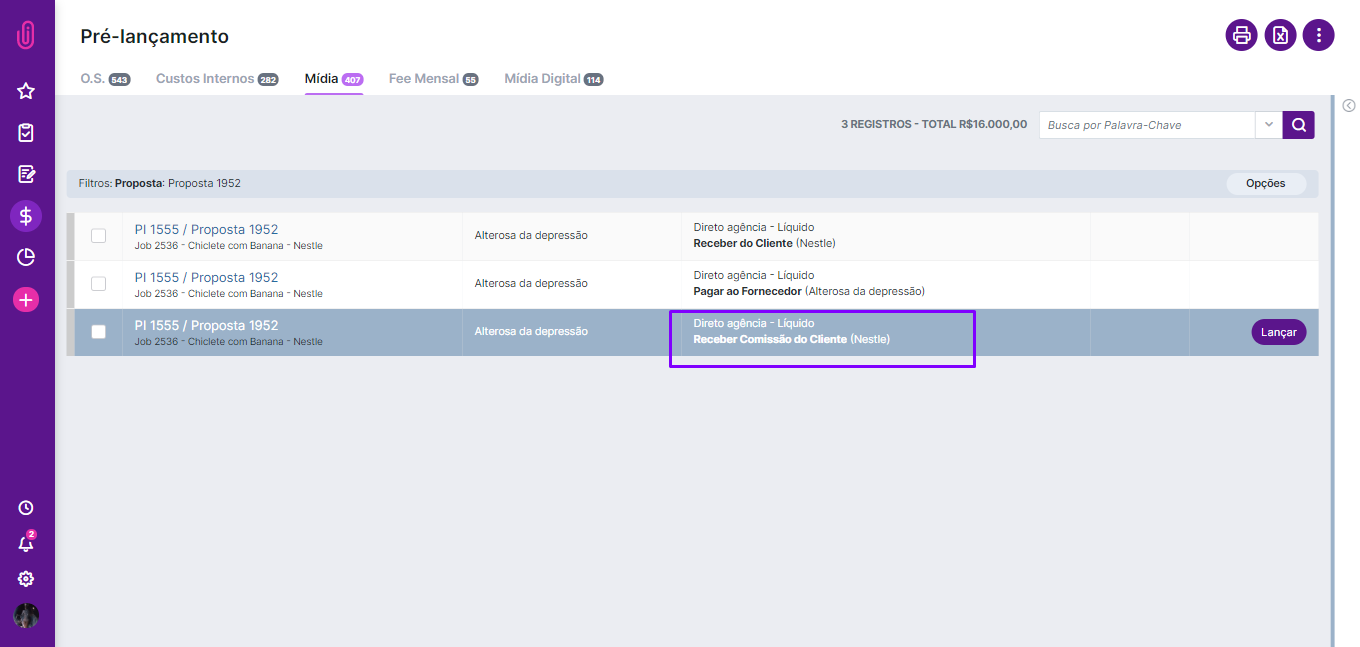

Direct to the agency

The collection is done on behalf of the agency, which must receive from the customer to then pay for the service. In this model, the agency assumes all costs of the project and the risk of possible default by the client.

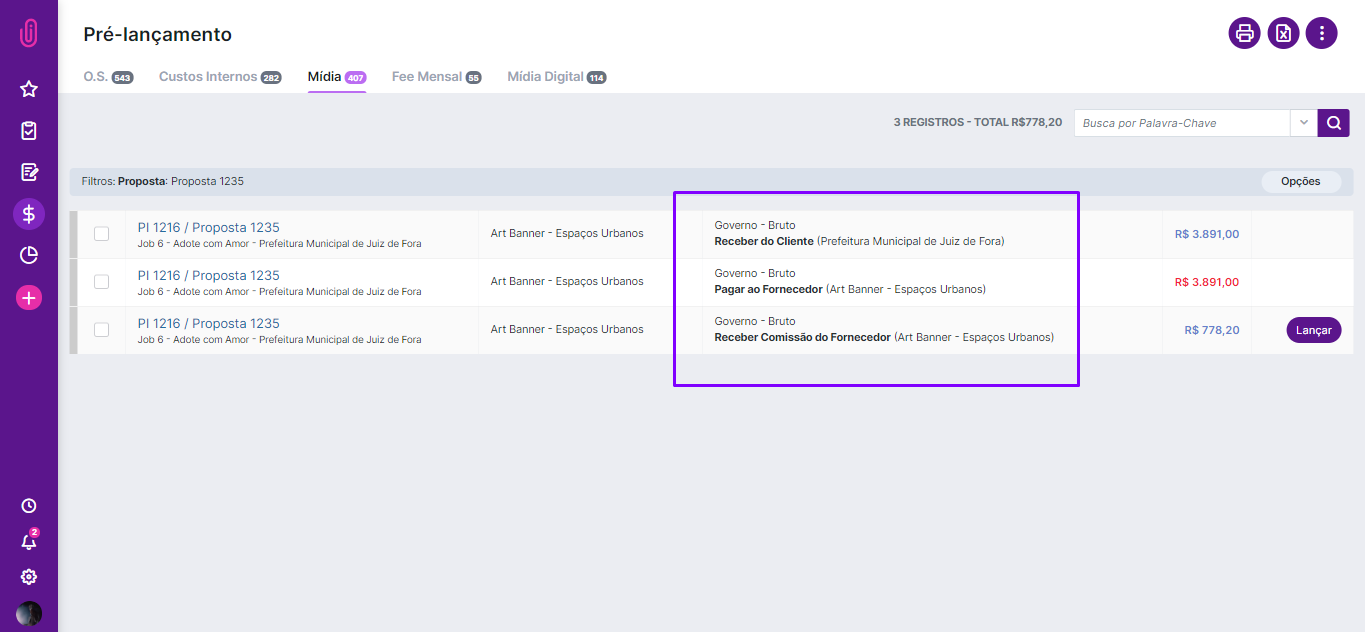

Direct to the government

The ‘Direct to the Government’ model works exactly like the ‘Direct to the Agency’, however, in this scenario, iClips alerts indicate that the agency is responsible for the transfer, but the invoice for vehicles/suppliers continues to be sent in the name of the client. In other words, the agency takes responsibility for the transfer, but not for the debt.

Important: Taxes

When the agency assumes the costs of the project and indicates that suppliers/vehicles will do the math, it will have to pass on the entire billing to the client. In this case, taxes will be levied on the total value of the invoice.

To avoid double taxation, the ideal is for negotiations to be done on the billing models ‘direct to the government’ or ‘direct to the client’. As we saw earlier, in the ‘direct to the government’ model, the agency takes responsibility for the transfer, but not the debt, and in the ‘direct to the client’ model, no amount that is not commission and honorary (if any) is entered. Then, when issuing the charge for the client, the agency will pay tax only on the exact value of service it provided.

Briefly, check out below an image that summarizes what was described above:

Still need help? Just call us at help@rockcontent.com or on the platform chat and we will help you out!

.png?height=120&name=rockcontent-branco%20(1).png)