We often receive and send invoices to clients in PDF format. It is visually easier to see the information and each prefecture or banknote issuing system can have a standard configuration to display the information.

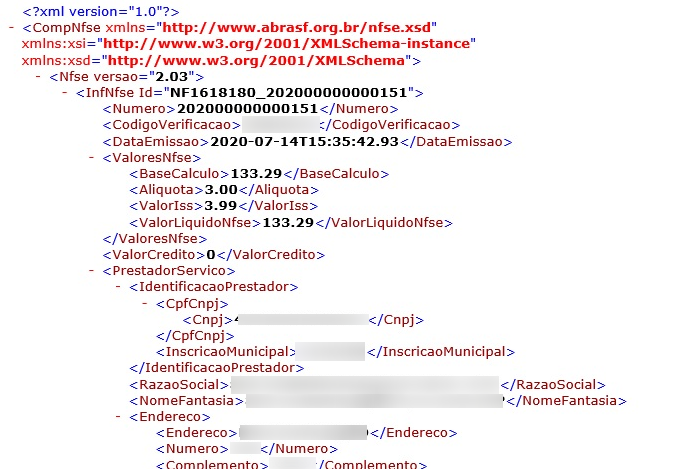

Therefore, these invoices also have a XML version, which is a standard format containing all the important information related to that invoice. Often, some information that is not visible in the PDF is contained in the XML and therefore is essential for configuring invoice issuing in iClips.

It is as if the XML is the note's identity and it is through it that the information is transmitted to the IRS and it is also that it has legal and fiscal validity. It contains data from the agency, the client, as well as information and values of the service provided and taxes.

When you issue invoices for the first time on iClips, XML will be essential for filling some data in Settings> Agencies> Invoice and taxes.

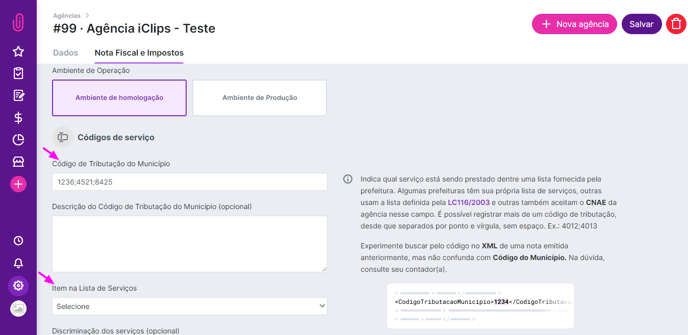

Both the municipality's tax code and the list of services can be found in the XML of your invoice. By hovering your cursor over these fields in iClips you can find it. If your agency has more than one tax code, just separate them with a semicolon and, at the time of issuing the invoice, the system will allow you to use one.

Through the invoice's XML, we can also find out if the agency's Employer Identification Number is part of any special tax regime and other particularities.

Many errors during the first issue are caused by filling failures, so always be careful when entering your data:

Client data (borrower)

To successfully issue an invoice, all your main information such as company name, EIN, address, email and phone number must be filled in correctly. The path is Settings > Clients.

Agency details (provider)

In Settings > Agencies > Data, fill in information such as company name, EIN, municipal and state registration, address and email.

In the Invoices and Taxes tab:

- Environment: always select the production environment, as not all prefectures allow emission through the approval environment.

- Service codes: these fields may change according to the city. They usually involve the municipality tax code and list of services item. This information will always be in your XML.

- Validation: here you enter your A1 certificate and password and/or login and password from the city hall.

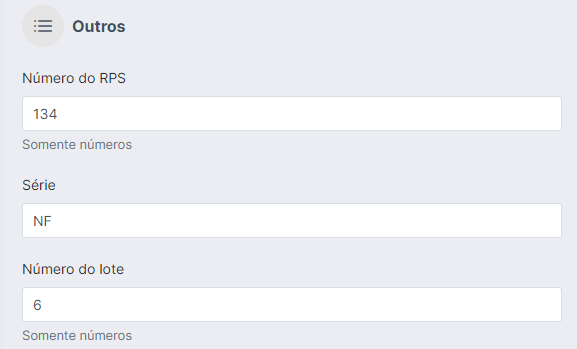

- In some cases the system also asks for the serial number, batch and RPS.

- The series can be found in the note XML. It is usually 1, E or NF.

- You can start the batch by placing the number 1.

- You can add the the number of the last invoice you issued at your city hall's website at the RPS.

- Taxes: in this field you will inform the approximate amount of taxes, if the EIN is part of any special tax regime and if the regime is simple or presumed profit and what are the rates.

After that you will be able to issue invoices.

Always remember that your accountant is your best friend at these times, as they have important information about your city and your EIN.

.png?height=120&name=rockcontent-branco%20(1).png)